In 2011, Netflix was riding high as the king of DVD rentals when they decided to split their streaming and DVD services, creating “Qwikster” – a move that cost them 800,000 subscribers and sent their stock plummeting by 77%. Why? They had misread their market and underestimated how the customers would react. Meanwhile, their competitor Amazon Prime Video was quietly studying consumer behavior and building a streaming service that would eventually become a major threat to Netflix’s dominance.

This story illustrates one simple truth: in the business world, what you don’t know can hurt you. Whether you’re running a global corporation or a local startup, understanding your market isn’t just helpful, it’s survival.

Competitive and market intelligence tools act as a business’s radar system. But with so many tools and so much data available, how do you know what’s actually worth your time and money? In this article, without getting lost in technical complexities, I’ll cut through the jargon and show you how modern market intelligence tools can help your business and what to look for in them.

What are Market and Competitive Intelligence Tools?

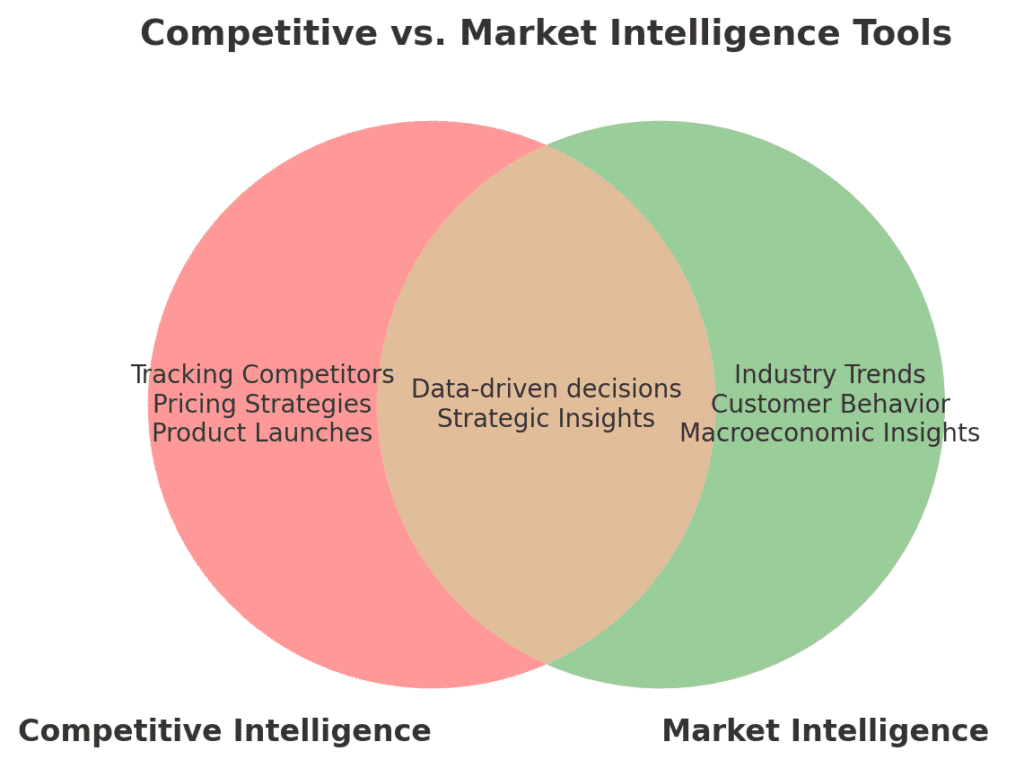

Competitive intelligence (CI) and market intelligence (MI) are related disciplines focused on gathering insights to help businesses. Competitive intelligence involves the systematic collection and analysis of information about rival companies – their strategies, products, pricing, and performance – to identify opportunities and threats. In contrast, market intelligence takes a broader view, examining the overall market landscape including customer behaviors, industry trends, and the competitive environment.

Imagine you run a coffee shop. A basic market intelligence tool might tell you that more people in your neighborhood are searching online for “oat milk lattes” (That’s market intelligence, i.e. understanding what customers want). A competitive intelligence tool can alert you that the coffee shop three blocks away has advertised dairy-free options (That’s competitive intelligence, i.e. knowing what your rivals are doing).

In simple terms, CI tools zoom in on competitors, while MI tools zoom out on the market at large. Both are ethical, legal forms of research (distinguished from any illegal espionage), relying on publicly available data and market research. Together, they provide a holistic view: MI offers big-picture context (e.g. emerging customer needs or industry trends) and CI provides granular insight into how specific competitors are acting and reacting.

How do Competitive and Market Intelligence Tools Work?

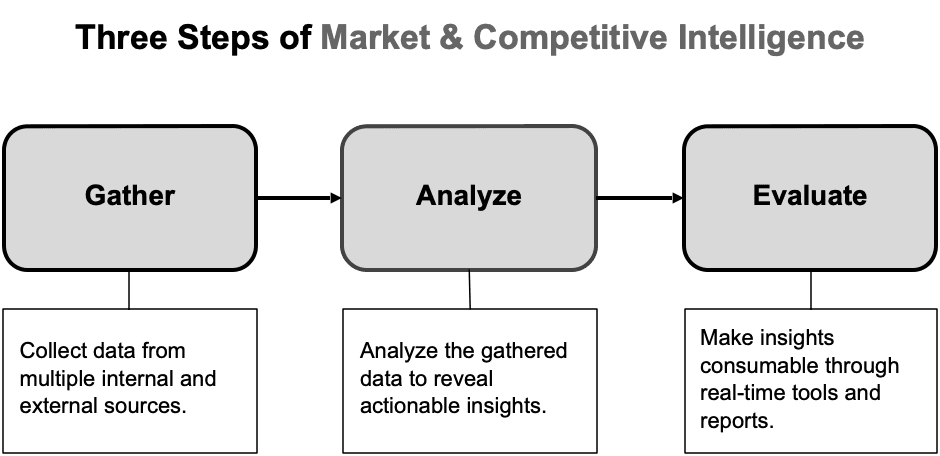

Businesses use these intelligence practices to anticipate market shifts, benchmark against competition, and uncover strategic opportunities. Effective CI and MI can be the difference between leading or lagging businesses in the market. These tools enable companies of all sizes to base decisions on data and evidence rather than guesswork, making intelligence functions incredibly important for sustainable success. They work by gathering publicly available data, analyzing it, and finally using the insights for the business to send relevant alerts and notifications.

The Cost of Not Knowing

Here’s what your business stand to lose when you fly blind:

Lost Customers You Never Knew You Had

Imagine running a restaurant and not realizing that potential customers are leaving negative reviews about your weekend wait times. By the time you notice declining weekend sales, those customers have already found new favorite spots. A simple social media monitoring tool could have caught these complaints early, letting you adjust your staffing or reservation system before losing those customers.

Money Left On The Table

Imagine, your competitors raise their prices by 15%, but you don’t notice for three months. If you’re selling 1,000 units a month at $100 each, that’s potentially $45,000 in revenue you missed out on, assuming your product could have supported a similar increase. Market intelligence tools could have alerted you to this pricing change on day one.

The “Too Late” Trap

Remember when hand sanitizer demand exploded in early 2020? Companies with good market intelligence tools saw the trend early and adjusted their production or stocked up. Those who didn’t found themselves scrambling – often too late – to catch up with market demands.

The Hidden Competitor

You’ve been watching your three main competitors for years, but didn’t notice the startup that was quietly building a better solution. By the time they launch their product, they’ve already secured major customers who didn’t even consider you. This happens more often than you might think; just ask taxi companies about how they felt when Uber seemed to appear “overnight. Competitive intelligence tools help you keep watch to prepare not just for the present, but also the future.

The Reputation Time Bomb

Without proper monitoring, a small customer service issue can snowball into a full-blown PR crisis. By the time it hits mainstream news, the damage is done. Companies with good intelligence tools can spot and address these issues while they’re still manageable.

4 Key Types of Intelligence Tools

Today’s intelligence tools come in many forms:

- Some scan news websites, social media, and online forums to catch mentions of your industry or competitors

- Others track pricing changes on websites, helping you stay competitive

- Some analyze customer reviews across different platforms to understand what people like or dislike

These tools range from high-tech software platforms to simple manual research methods. Broadly, they can be grouped into a few categories based on their approach:

1. AI-Powered Intelligence Platforms

What are they? These are modern tools that use artificial intelligence (AI) and machine learning (ML) to automate data gathering and analysis. AI-powered platforms can continuously scan vast amounts of information (news, websites, financial filings, social media, etc.) and use algorithms to identify relevant insights.

How do they work? For example, using natural language processing to read through millions of documents (like SEC filings, earnings call transcripts, and news articles) and then deliver concise summaries of key developments.

What’s the benefit? The advantage of AI-driven tools is speed and scale – they can catch signals that a human might miss and update insights in real time.

2. Manual Research & Free Tools

What are they? Not all intelligence gathering requires fancy software; a lot can be done with manual methods and free resources. Manual competitive research might include reading competitors’ websites and press releases, subscribing to their newsletters, visiting their stores, or attending industry conferences and trade shows to observe announcements. They also include simple free tools that assist with manual tracking.

How do they work? For example, Google Alerts allows you to set up email alerts for specific keywords (such as a competitor’s name or a product term) – whenever new content on the web mentions those keywords, you get notified. Teams can also use RSS readers (like Feedly) to aggregate news from industry blogs, or set up basic spreadsheets to track information.

What’s the benefit? While manual methods can be time-consuming and might not catch everything, they are accessible to even the smallest businesses and can form the foundation of a competitive intelligence effort without requiring budget.

3. Data Aggregation & Monitoring Platforms

What are they? These tools focus on gathering data from multiple sources into one dashboard or database, making it easier to analyze the competitive landscape. Data aggregation platforms often specialize in certain data types.

How do they work? For instance, some tools monitor website analytics and traffic (e.g. SimilarWeb, which tracks website visitor statistics and online engagement metrics) to compare your web presence against competitors. Others aggregate industry news and reports – for example, platforms like Contify or InfoDesk pull news from thousands of sources (across many languages) and de-duplicate and categorize it for analysis. There are also monitoring tools for specific aspects like social media listening (tracking brand or product mentions across social networks), or review monitoring (collecting online customer reviews for your business and competitors).

What’s the benefit? These aggregation tools save time by consolidating information and often provide analytics or visualization features. They can automatically track KPIs such as competitor website traffic, share of voice in media, product launch timelines, and more, giving a comprehensive view of where you stand in the market.

4. Industry-Specific Intelligence Solutions

What are they? Many industries have specialized intelligence tools tailored to their unique needs. These solutions often include proprietary datasets or domain-specific metrics.

How do they work? For example, in the pharmaceutical and biotech sector, companies use intelligence platforms that track clinical trial databases, FDA approvals, and scientific publications to stay on top of competitors’ drug pipelines. In retail and e-commerce, businesses might use price intelligence tools (like dynamic pricing software) that monitor competitors’ product prices in real time and even adjust their own prices accordingly.

What’s the benefit? The key point is that one size may not fit all – a manufacturing firm might need a very different toolset than a tech startup. Industry-specific solutions fill those gaps by providing the exact data and insights relevant to a particular sector.

In practice, businesses often use a combination of these tool types. Say, a company could use an AI platform to automate broad monitoring, free tools like Google Alerts for niche topics, an aggregation dashboard for tracking KPIs, and an industry-specific database for deep dives – all together forming an intelligence “stack.”

List of Popular Competitive & Market Intelligence Tools

Below is a curated list of popular competitive and market intelligence tools, categorized by the size of business: small firms, mid-size companies, and large enterprises. We include key features of each tool and their typical pricing model (note that prices can change with time and enterprise tools often require custom quotes).

Tools for Small Businesses

Small businesses usually look for tools that are low-cost (or free) and easy to use. These tools often emphasize quick wins – basic competitor monitoring, online research, and simple alerts – without requiring dedicated analysts. Here are some examples of those.

| Tool | Key features | Pricing |

| Google Alerts (Google) | Monitors the web for chosen keywords and sends email updates. Useful for tracking mentions of your company, competitors, or industry topics. | Free to use (no cost). |

| Owler | Crowd-sourced business intelligence with millions of company profiles. Provides competitor news, company updates, funding alerts, and community-generated insights. Customizable watchlists and email newsletters about your competitors. | Freemium model – Community version is free, and a Pro plan is available (~$39/month billed annually) for advanced features (free forever – Owler). |

| Social Mention | A social media search and analysis tool that aggregates user-generated content from across the web. Helps small businesses see what people are publicly saying about competitors or industry keywords in real-time. | Free (web-based tool). |

| Prisync | Specialized in competitor price tracking for e-commerce. Automates monitoring of competitor product prices and stock availability, with dynamic pricing suggestions. Great for small online retailers to stay price-competitive. | Subscription service starting around $99/month for basic plans (e.g. tracking up to 100 products) (Pricing – Prisync). Higher tiers allow more products to track. |

| SpyFu | An SEO and Google Ads competitor research tool. Allows users to see which keywords competitors rank for, their Google Ads history, and other search marketing secrets. Helps identify which search terms drive traffic for competitors. | Subscription with affordable plans (Basic approx $39/month on monthly billing) (11 Best Competitive Intelligence Tools for Organizations in 2025); discounts if paid annually. |

| Crunchbase | A database of startup and private company information. Useful for market intelligence on smaller companies – provides info on funding rounds, key executives, and company profiles. Small businesses can use it to research partners or emerging competitors. | Free tier with limited info; Crunchbase Pro ~$29/month for full access (monthly or annual subscriptions available). |

Notes: Many of these small-biz-friendly tools have free versions or trials. Combining multiple free tools (for example, using Google Alerts + a free Owler account + manual social media checks) can cover a lot of ground for a minimal budget.

Tools for Mid-Size Businesses

Mid-sized businesses tend to require more comprehensive intelligence and often have a budget for professional tools. They may need to monitor a broader set of competitors or markets, and they benefit from tools that provide integration and collaboration features. The following tools are popular in mid-market companies for competitive and market intelligence:

| Tool | Key Features | Pricing |

| SEMrush | An all-in-one digital marketing intelligence suite. Offers competitor analysis for SEO (search rankings, backlinks), PPC advertising research, content and social media tracking. Mid-sized firms use it to benchmark their online visibility against competitors and discover competitor marketing strategies. | Tiered subscription plans. Pro plan is ~$129.95/month (suitable for SMEs), Guru at ~$249.95/month with more features, and Business at ~$499/month for larger teams |

| SimilarWeb | A digital market intelligence platform focusing on web and app analytics. Provides estimates of any website’s traffic volume, traffic sources, audience demographics, and engagement metrics. Useful for comparing market share online and spotting traffic trends. Also offers industry analysis (e.g. top players in a category). | Subscription plans for different needs. Starter around $125/month for basic web metrics, Pro around $433/month for fuller competitive intelligence features, and Enterprise custom plans with advanced capabilities. |

| Crayon | A dedicated competitive intelligence platform. Continuously monitors competitors’ digital footprints – tracking website changes, product updates, news, and even job postings. Aggregates insights into a dashboard and generates “battlecards” for sales teams (summaries of how to win against competitors). Designed to enable cross-team sharing of competitive intel. | Enterprise SaaS pricing – typically custom quotes based on number of users and competitors tracked. (Known to cater to mid-to-large B2B companies, so pricing is on request.) |

| Klue | A competitive enablement platform often used by product marketing and sales enablement teams. Klue collects intel on competitors (from news, web, and internal sources) and organizes it into digestible cards or newsletters. Emphasizes helping sales teams with real-time competitor insights and battlecard libraries. | Quote-based pricing. Aimed at mid-market and enterprise customers; pricing depends on scope (number of competitors, etc.) and usually involves an annual subscription. |

| WatchMyCompetitor (WMC) | An automated competitor tracking platform that combines AI and human analysis. It monitors competitors’ “digital footprint” (websites, social media, news) in real-time and curates the data with human analysts to ensure relevancy. Provides a centralized dashboard, custom reports, and alerts. Good for getting a distilled feed of competitor actions without the noise. | Subscription with custom pricing based on number of competitors tracked and features needed. (WMC doesn’t publicly list prices; costs scale with the breadth of monitoring. |

| Brandwatch (Consumer Intelligence) | (Example of a social intelligence tool for mid-size firms.) Brandwatch gathers insights from social media, forums, blogs, and news about your brand and competitors. It uses AI to analyze sentiment and trends. Medium-sized companies use it to gauge public perception of competitors and emerging topics in their market. | SaaS subscription, priced by data volume and features. Typically requires a contract in the thousands of dollars per year range (suitable for mid-to-large companies with a dedicated marketing analytics budget). |

Notes: Mid-sized businesses often use a mix of general-purpose tools like the above. For instance, a company might use SEMrush for digital marketing intel, plus a specialized CI platform (Crayon/Klue) for broader competitive tracking. Integration becomes important at this stage – many of these tools can integrate with CRMs, Slack, or BI dashboards so that intelligence is woven into the company’s workflows.

Tools for Large Enterprises

Enterprise-level organizations usually have dedicated market intelligence and competitive analysis teams, and they invest in more powerful intelligence platforms and data services. These tools often provide advanced analytics, huge data coverage, and enterprise integrations (with CRMs, data warehouses, etc.). Here are examples of intelligence tools and services used by large companies:

| Tool | Key Features | Pricing |

| AlphaSense | A premium market and competitive intelligence platform powered by AI. AlphaSense indexes a vast array of content – SEC filings, earnings call transcripts, industry research, news, trade journals, etc. – and uses natural language search to surface insights. Analysts at large firms use it to quickly find information on competitors and market trends (for example, searching across all transcripts for mentions of a new technology). It also offers AI-driven summaries and trend detection. | Enterprise subscription (no public pricing; custom quotes). Cost scales with number of users and data modules. It’s known to be high-end – often a significant investment for S&P 500-level companies. |

| Bloomberg Terminal | An iconic financial intelligence system for enterprise finance and investment firms. It provides real-time market data, stock quotes, financial news, economic indicators, and company information, all in one interface. While primarily used in finance, corporations also use it for market intelligence on industries and competitors (e.g. to track a competitor’s stock performance or news). | High-cost subscription – approx $30,000 per user per year as of 2025. Bloomberg Terminals are leased on yearly contracts; volume discounts apply for multiple licenses. This pricing reflects its specialized value for enterprise users. |

| Dow Jones Factiva | A business news and information database used for market intelligence and research. Factiva provides access to 34,000+ premium news sources from around the world (many not available free on the web) (). Corporate intelligence teams use it to search deep news archives, set up alerts on topics/companies, and extract industry insights from global media. It’s invaluable for comprehensive coverage of market developments and competitor mentions in press. | Enterprise licensing – pricing is custom (usually based on number of users and content access needed). Large organizations typically negotiate an annual license; it’s a significant cost but provides enterprise-wide access to a massive news archive. |

| Valona Intelligence (M-Brain) | A market and competitive intelligence platform that combines AI technology with human analysis (similar in spirit to WMC, but geared for large enterprises). It offers a full suite: global news tracking, trend radar, dashboards, and even analyst services. Enterprises use it to build a centralized intelligence hub covering competitors, customers, and market trends, with collaboration features for different departments. | Enterprise SaaS – custom pricing based on scope. Typically involves an annual platform fee plus possible add-ons for analyst support. (Valona is positioned for Fortune 500 clients, often as a comprehensive intelligence solution). |

| Gartner or Industry Research Portals | (Representative of research subscription services.) Many enterprises subscribe to industry analyst firms like Gartner, Forrester, IDC, or Euromonitor. These services provide market intelligence reports, competitor benchmarking, and trend analyses in specific domains (IT, consumer markets, etc.). Although not “tools” in a software sense, these subscriptions are important parts of the market intelligence toolkit at large companies, offering expert insights and data. | Pricing varies: often five to six figures annually for enterprise-wide access to research libraries or analyst advisory services. Companies pay for the breadth and credibility of insights to inform strategic decisions. |

Notes: Large enterprises often deploy multiple intelligence tools in parallel. For example, a global bank might use Bloomberg Terminal for financial market intel, AlphaSense for document search, and Factiva for news, while also maintaining an internal intelligence portal to share insights across the company. Integration and security are important at this scale – tools need to fit into corporate IT environments and handle access controls, etc.

No matter the size of your business, the key is selecting tools that fit your objectives and budget.

Industry Use Cases & Examples

To understand how competitive and market intelligence tools provide value, take a look at these real-world examples of intelligence tools in action. Businesses across various industries use them in creative ways to gain insights and stay ahead.

• Airline Industry – Dynamic Pricing Wars

Airlines engage in intense competitive intelligence for pricing. It’s common practice for carriers to monitor their rivals’ ticket prices on various routes daily. If one airline drops prices for a route or runs a fare promotion, others quickly detect it and often match the price change within hours. Conversely, if a competitor raises prices, airlines see an opportunity to increase their own fares.

This real-time tracking of competitor pricing, often done with specialized revenue management software, is a textbook example of CI. It’s the reason airfare prices can change multiple times a day – airlines are responding to each other’s moves in near real time. Intelligence tools make this possible by automatically scraping fare data and alerting pricing managers to any significant shifts.

• Retail or E-Commerce – Amazon’s Price Monitoring

In the retail world, Amazon famously uses competitive intelligence to ensure it rarely gets undercut. Amazon tracks millions of product prices across its platform and external e-commerce sites. If a competitor (say, Walmart.com) lowers the price on a popular item, Amazon’s systems quickly detect that and often algorithmically adjust Amazon’s own price to match or beat it.

This practice, powered by real-time price monitoring tools, helps Amazon maintain a reputation for low prices. The impact is huge in e-commerce – customers often gravitate to the seller with the best price. By using automated competitor price intelligence, Amazon gains a tactical advantage in conversion rates and sales. Many other online retailers have adopted similar tools to monitor each other (for example, tracking prices on eBay, Shopify stores, etc.), showcasing how critical competitive intel is in the retail sector.

• Automotive – Feature Benchmarking

Automobile manufacturers keep a close eye on competitors’ vehicle features and technological innovations. A great example is the race toward electric and autonomous vehicles. When Tesla began achieving success with long-range electric cars and advanced self-driving features, traditional automakers like GM, Ford, and Toyota accelerated their own electric vehicle programs in response. They were monitoring Tesla’s moves (product announcements, patent filings, consumer interest) as competitive intelligence inputs to their strategy. Another classic example: safety features such as airbags. One company first introduced airbags in the 1970s, and as it proved to be a desirable feature, nearly all competitors followed suit well before it became legally mandated.

Automakers use CI tools like teardowns (physically analyzing competitors’ cars), industry reports, and even social media sentiment analysis to gauge which features consumers value. This intelligence directly informs their product development roadmap so they’re not left behind on critical innovations.

• Tech Disruption – Airbnb vs. Hotels

Competitive intelligence is not only used by large incumbents; disruptors and startups leverage it to find market gaps. Airbnb is a great example of a company that identified an unmet need in the travel lodging market by closely studying customer preferences and pain points (an aspect of market intelligence) and observing the slow innovation of traditional hotels. They noticed travelers were looking for affordable, authentic alternatives to hotels – something competitors (hotels) were not providing. By acting quickly on these insights and monitoring how hotels responded, Airbnb was able to capture a huge market share before big hotel chains could react.

On the flip side, hotel companies now heavily invest in CI tools to monitor Airbnb’s moves (pricing in various cities, new experience offerings, marketing campaigns) so they can adjust their own strategies (for instance, some hotels started highlighting “local experiences” or launching their own home-rental divisions in response). This case shows how intelligence on customer trends and competitor actions together enabled a smaller player to disrupt an industry, and forced incumbents to adapt.

• Fast Food – “Chicken Sandwich Wars”

A fun example of rapid competitive reaction comes from fast food. In 2019, Popeyes launched a new fried chicken sandwich that became a viral sensation, drawing long lines of customers and selling out nationwide. Sensing a competitive threat to their market, Chick-fil-A (a rival chicken sandwich specialist) quickly responded on social media, and other brands like Wendy’s and McDonald’s soon stepped up with enhanced chicken sandwich offerings of their own. Within months, nearly every major fast-food chain had introduced or heavily promoted a chicken sandwich.

What happened here is that Popeyes’ rivals were closely tracking its product launch and the buzz it generated – likely through social media monitoring (to gauge consumer reactions and virality) as well as sales intelligence (store traffic reports, etc.). The competitors used that intelligence to fast-track their responses and marketing messaging. This “chicken sandwich war” is a prime example of competitive intelligence in a very reactive form: companies monitoring each other’s product launches and quickly countering to avoid losing customers. It paid off – the intense competition expanded the overall market for chicken sandwiches and kept each player in the conversation.

These examples span different industries, but all highlight the value of being tuned in to the external environment. Whether it’s adjusting prices immediately, developing matching features, or seizing on a rival’s momentum, competitive and market intelligence enable businesses to make agile moves with confidence.

How to Choose the Right Tool

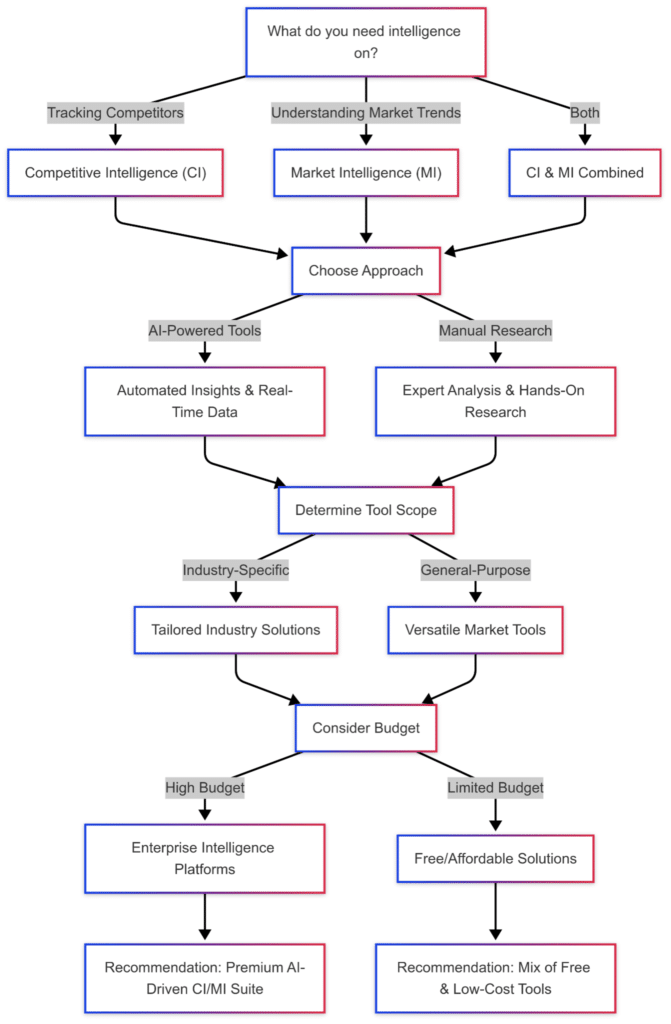

Selecting a competitive intelligence tool (or a set of tools) can be challenging given the many options. It’s important to approach the decision systematically. Here’s a framework to help choose the best tool for your business needs:

Assess Your Business Needs and Goals

Begin by clearly defining what you want from an intelligence tool. Identify the specific questions you need answered or problems you aim to solve. For example, are you trying to track competitors’ pricing daily? Monitor industry news and trends? Gather intelligence to enable your sales team?

Different needs may point to different tools. Also consider your industry dynamics – a fast-evolving tech sector might require real-time alerts, whereas a more stable industry might be fine with periodic reports. By understanding what insights you need and why, you can narrow the field to tools that align with your strategic goals. If possible, list your “must-have” use cases to match against tool features.

Decide on Data Scope: Real-Time vs. Historical

Determine whether you need real-time intelligence, historical data analysis, or both. Some tools excel at real-time monitoring – sending instant alerts when a competitor does something (great for quick reactions). Others focus on historical data and trends, letting you analyze patterns over months or years (useful for strategic planning).

For instance, if your market changes rapidly (tech, online retail, etc.), real-time alerts might be crucial. Conversely, if you’re doing a market entry study, a database of several years of industry data could be more valuable. Knowing your required data freshness will help in choosing a tool that specializes in that area.

Evaluate Features and Capabilities

Once you have your needs outlined, evaluate each candidate tool’s features against that checklist. Key things to consider include: data coverage (does it track the sources you care about, e.g. social media, news, product listings, financial filings?), analytics (does it just collect data, or also provide analysis like charts, comparisons, or AI-driven insights?), and ease of use (is the interface user-friendly, can you easily set up the alerts or reports you need?).

Some tools are all-in-one but may have a learning curve, while others are simpler but do one thing really well. It’s wise to read user reviews and case studies if available – these can reveal if a tool has strengths or weaknesses in certain areas. For example, users might praise a tool’s accurate data but complain that the interface is difficult – that’s valuable to know in advance. Make sure the tools you consider actually solve the problems you identified in step 1.

Consider Integration and Workflow

Think about how the tool will fit into your company’s workflows. A great intelligence platform that nobody checks regularly is not useful – so consider integration with your existing systems. Many modern CI tools can integrate with Slack, Microsoft Teams, email, or your CRM, so that intelligence is pushed to the places your team already works.

If you have a Business Intelligence (BI) dashboard or collaboration portal, see if the tool can feed data into it or if it provides APIs for custom integration. Also consider the format of outputs – do you need PDF reports for executives, or raw data for an analyst, or real-time alerts for sales reps? Ensure the tool can deliver intelligence in a way that your stakeholders will actually use.

Budget and ROI Analysis

Cost is a significant factor for most businesses. Intelligence tools range from free to very expensive, so you’ll need to find an option that fits your budget while still meeting core needs. When comparing pricing, look beyond the sticker price – consider the value the tool brings. A cheaper tool might lack crucial features you need, whereas a more expensive tool might provide substantial time savings or revenue opportunities that justify the cost.

Calculate the potential ROI: for instance, if this tool alerts me to a major market shift 3 months earlier, what is that worth to my business? Also factor in how the pricing scales (some tools charge per user, per competitor tracked, or per data volume). Ensure you understand the pricing model so you won’t be surprised by costs as your usage grows. It’s often helpful to set a budget range beforehand and focus on options within that range, unless a higher-priced tool clearly delivers unique value that others don’t.

Finally, whenever possible, take advantage of free trials or demos. Almost all software vendors will offer a trial period or at least a live demo of the product.

Final words

Choosing the right tool is only the beginning. To maximize the value of competitive and market intelligence, focus on effective implementation and ongoing process to truly use competitive and market intelligence tools to improve decision-making and performance. This will ensure the insights gleaned don’t just sit in a report, but actively drive smarter actions across the business.

Be sure to integrate these tools into daily work, encourage collaboration, train users, and continuously audit and refine your process. With the right competitive and market intelligence tools and the right practices, even small insights can yield big advantages; converting these tools into a powerful growth engine for your business.

Key findings:

- Small businesses can start with free and low-cost tools (under $100/month) to maintain basic competitive awareness without significant investment. The trade-off of free tools will be that they may have limited depth or require more manual effort, but they are a great starting point for establishing competitive awareness.

- Pricing for mid-market tools ranges widely (from a couple hundred to a few thousand dollars per month), so evaluating ROI and focusing on needed features is key. Make sure the tools offer the best balance of features and cost for growth, with robust integration capabilities.

- At the enterprise level, costs are high, but so are the stakes. These organizations must focus on integration with existing workflows (like CRM, Slack, etc.) and security of these tools so they can be easily scaled across the company.

- Real-time monitoring and AI-powered analysis are becoming standard features, enabling faster response to market changes.

- Industry-specific solutions often provide better ROI than general-purpose tools due to specialized datasets and metrics. The most successful implementations combine multiple tools to create a comprehensive intelligence stack.